Starting a business is a dream for many in both the United States and throughout the world. With an E-2 visa, entrepreneurs from other countries have the opportunity to start and run a business in the U.S.

What is an E-2 Visa?

As explained by the U.S. Citizenship and Immigration Services, “The E-2 nonimmigrant classification allows a national of a treaty country (a country with which the United States maintains a treaty of commerce and navigation, or with which the United States maintains a qualifying international agreement, or which has been deemed a qualifying country by legislation) to be admitted to the United States when investing a substantial amount of capital in a U.S. business.” To qualify for an E-2 visa nonimmigrants must be coming with the sole purpose of growing and operating the business in which they invested. What is considered substantial capital will change some based on the business the E-2 visa holder wishes to operate, but is generally seen as a large enough proportion of the business costs to ensure the E-2 visa holder will be able and committed to operating and sticking with the business. The capital must also be at risk of being lost if the business fails. As stated by the USCIS “investment is the treaty investor’s placing of capital, including funds and/or other assets, at risk in the commercial sense with the objective of generating a profit.”

Nonimmigrants must apply to receive E-2 visa status. If the applicant is a lawful nonimmigrant in the US they must submit form I-129 to request E-2 status. Those outside the U.S. should visit the U.S. Department of State website for information on how to apply.

E-2 Visas are granted on a two year basis for those working and investing in a viable business that is actively operating or growing. Additionally applicants must be at least 50 percent owner of the business or hold an operationally significant managerial position to be accepted. At the end of the two years, E-2 Visa nonimmigrants can renew their status for another two years. There is no limit on the number of years an E-2 visa holder can remain in the United States as long as their visa is renewed.

How All County® Works with E-2 Visas

How All County® Works with E-2 Visas

Many All County® Franchisees have successfully built their property management businesses through E-2 visas. Success is largely the result of the work put in by franchisees, but All County does everything it can to ensure a smooth and effective transition into the American culture and economy. There are some automatic advantages for E-2 visa applicants looking at a property management business because the industry is one with a lower barrier to entry than many other franchise systems. There is a franchising fee and startup costs, but with no inventory to purchase franchisees can focus their money on marketing to grow their business. Aside from the financial benefits the property management industry provides, All County delays the monthly franchising fee typically charged to franchisees until the E-2 visa holder is actually in the United States.

Additionally E-2 visa franchisees will be provided with additional support as they begin to operate their business while also adjusting to life in America. Most E-2 visa applicants are coming from another country, and All County understands that learning how to navigate the layers of the governmental bureaucracy can be difficult especially in a new culture. All County is committed to helping E-2 visa franchisees with everything from applying for a business and real estate license to leasing an office space to acquiring a drivers license and leasing a residence. At times All County has even assisted in interviewing potential employees for E-2 visa franchisees.

For those looking to start a business and begin a new life in America, E-2 visas can be a particularly helpful resource. As long as the E-2 business owner is actively invested in their company and remembers to renew their visa every two years, an E-2 visa can be the catalyst to a successful career. At All County we recognize this, and work hard to assist E-2 visa applicants looking to join our system with everything from funding a business to settling into a new way of life.

Sources

https://uk.usembassy.gov/visas/treaty-trader-or-treaty-investor/treaty-investor-e-2/

https://www.uscis.gov/working-in-the-united-states/temporary-workers/e-2-treaty-investors

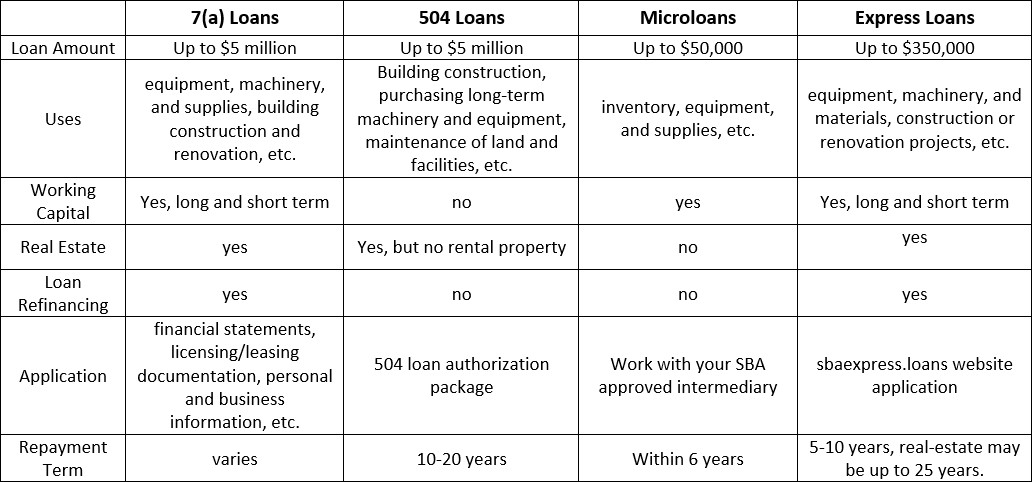

7 (a) Loans

7 (a) Loans

Express Loans

Express Loans

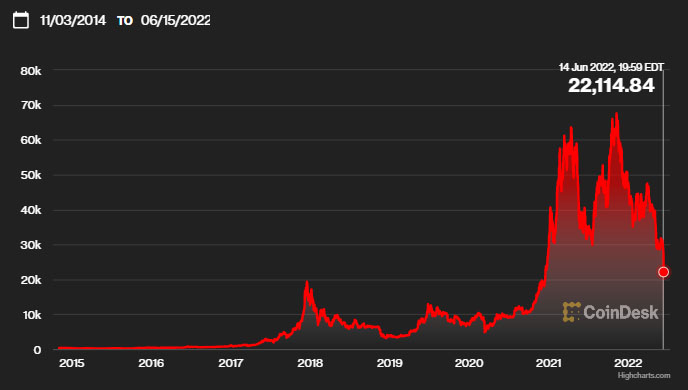

SBA Loans in Practice

SBA Loans in Practice

The

The